Highlights

- The No Surprises Act was signed into law in late 2020 and will go into effect in January 2022.

- The No Surprises Act seeks to lessen insured Americans’ worries about how to pay for surprise medical bills by increasing transparency regarding medical billing and patient cost-sharing responsibility.

- Because of the law’s new requirements, healthcare payer organizations must take steps now to ensure compliance by January 2022.

The No Surprises Act was signed into law in December 2020. Here’s what healthcare payers should know to prepare before the law goes into effect on January 1, 2022.

📄✍🚨With the passage of the No Surprises Act, the regulatory pressures on healthcare payers and providers continue to increase. Read our guide on the 6 actions payers can take to prepare.

What’s the “surprise” in the No Surprises Act?

The No Surprises Act, a $1.4 trillion year-end spending bill centers on so-called “surprise medical billing,” which is actually more commonly known as out-of-network billing. Out-of-network billing happens when a patient receives a bill for the difference between the out-of-network provider’s fee and the amount covered by the patient’s health insurance after copays and deductibles.

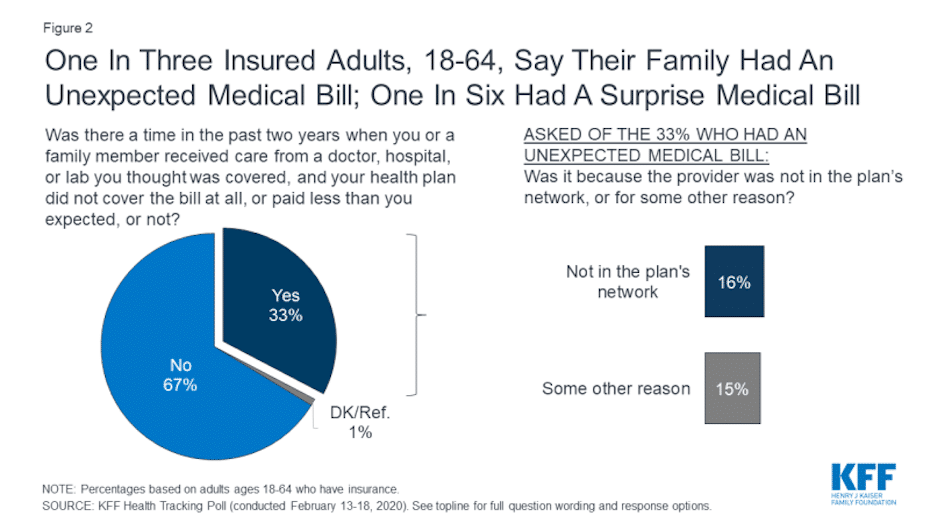

How often does that actually happen? According to a KFF poll, 1 in 3 insured adults between the ages of 18 and 64 received an unexpected medical bill in the last two years. Of those, 16 percent reported they received a “surprise” bill related to care received from an out-of-network provider.

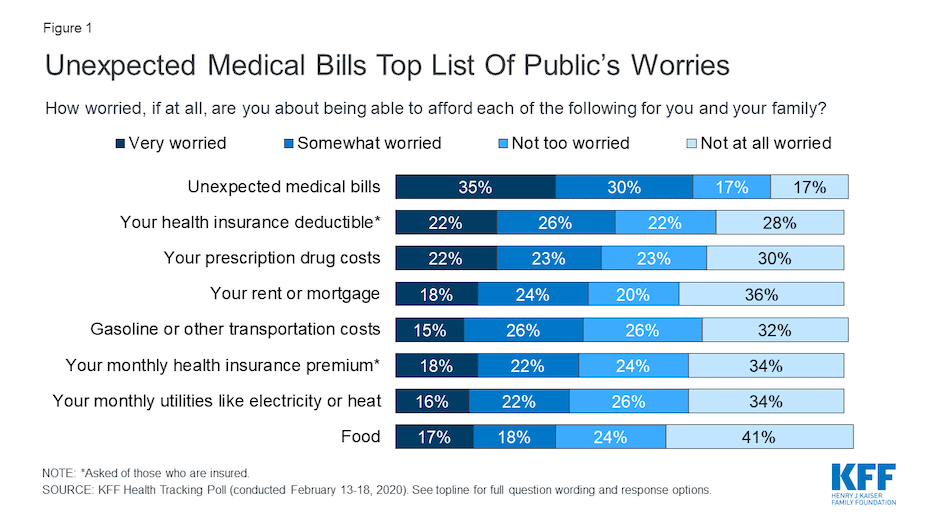

Further, 65 percent of insured adults between 18 and 64 indicated they are either “very worried” (35 percent) or “somewhat worried” (30 percent) about being able to afford unexpected medical bills. That concern topped the list of things this age group worries about.

What the No Surprises Act covers

The No Surprises Act seeks to lessen this worry for insured Americans by increasing transparency regarding medical billing and patient cost-sharing responsibility. Here are the main requirements of the law:

- Private health plans must cover surprise bills at the in-network rate without prior authorization, and in-network cost sharing must apply.

- In-network cost sharing for surprise bills will be based on the “recognized rate,” which is usually the median in-network amount for the same or similar services.

- If patients feel that their healthcare plan has not correctly handled a surprise bill, the patients have a right to take advantage of federal external appeals to remedy the situation.

- Out-of-network providers of emergency or non-emergency services at in-network hospitals are not allowed to balance bill patients beyond the applicable in-network cost sharing amount for surprise bills.

- The law specifies that providers “shall not bill, and shall not hold patients liable” for an amount that is more than the in-network cost sharing amount for such services.

- For private health plans regulated at the state level, states may enforce federal requirements. If those states fail to do so, federal fallback enforcement is required.

- For self-insured health plans, the federal government has enforcement responsibilities.

- A violation of the No Surprises Act may result in a state enforcement action or federal civil monetary penalties of up to $10,000 per violation.

Are there exceptions to the new regulations?

There are some exceptions to the new regulations. If a patient knowingly and willingly consents to use an out-of-network provider for non-emergency services, the surprise billing protections do not apply.

KFF notes regarding this exception: “An exception applies for certain non-emergency services if providers give prior written notice at least 72 hours in advance and obtain the patient’s written consent. The notice must indicate the provider does not participate in-network, provide a good faith estimate of out-of-network charges, and include a list of other participating providers in the facility whom the patient could select. This exception does not apply for ancillary services (such as anesthesia) or diagnostic services (such as radiology and lab) nor to other services or providers” specified in the regulation.

What the No Surprises Act means for payers

The No Surprises Act requires several things from payer organizations.

- Health plans must provide an advanced explanation of benefits for scheduled services for patients requesting them. Within three business days, payers must provide written information including whether the provider or facility participates in-network, and a good faith estimate of what the plan will pay and what the patient cost liability may be.

- Health plans must provide transitional continuity of coverage when a provider leaves a network. In some cases, such as when a patient is participating in ongoing care for a serious illness or pregnancy, the health plan must provide continuity of coverage at the in-network rate.

- Health plans must verify and update provider network information at least every 90 days.

- In the case of individual health plans, health plans must disclose information about broker commissions.

What should payer organizations do to prepare now?

2022 is fast approaching, so payer organizations must take action now to prepare. Here are some steps to take:

- Analyze your claims data to determine your level of exposure to surprise billing.

- Review any surprise billing state-level regulations to ensure compliance.

- Allocate sufficient resources to provide advanced explanation of benefits statements upon request.

- Implement a process for updating your provider network directory regularly, and allocate appropriate resources to ensure that process is followed.

- Review in-network contracts and reach out to new providers to reduce the chances of surprise claims and mitigate their associated financial risks.

- Create a member education strategy to build transparency regarding pricing and out-of-network providers.

Let RingCentral help you implement a member engagement communication plan

As regulatory pressures continue to increase, member engagement will become even more important than ever before. Educating and engaging your members will help you mitigate risks, retain members, and keep costs lower for all your members.

RingCentral provides a healthcare communications platform that enables strong member engagement across multiple channels—channels that your members prefer. To learn more about what RingCentral can do for your payer organization, get in touch and request a demo today.

Originally published Nov 16, 2021, updated Nov 09, 2021