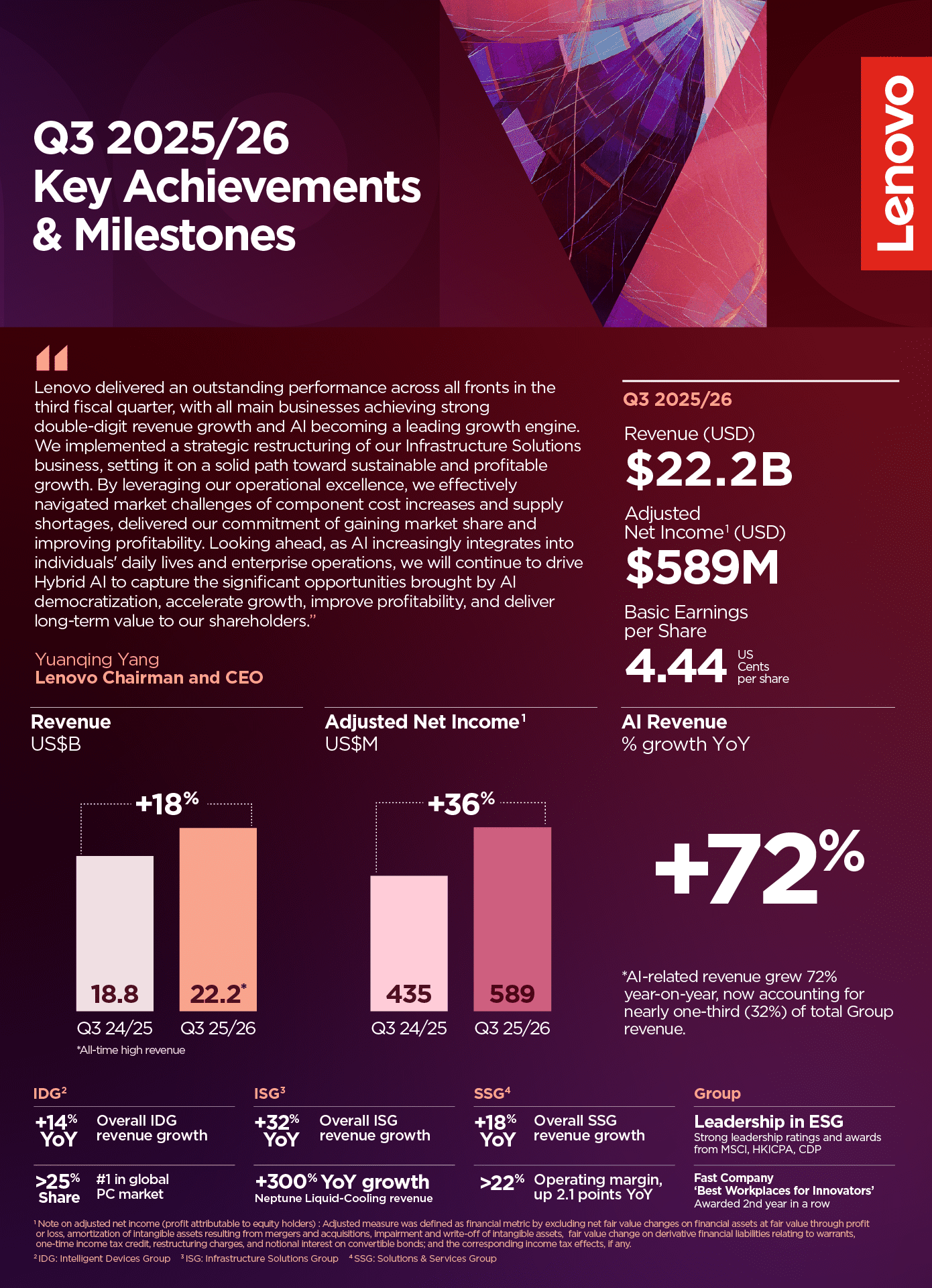

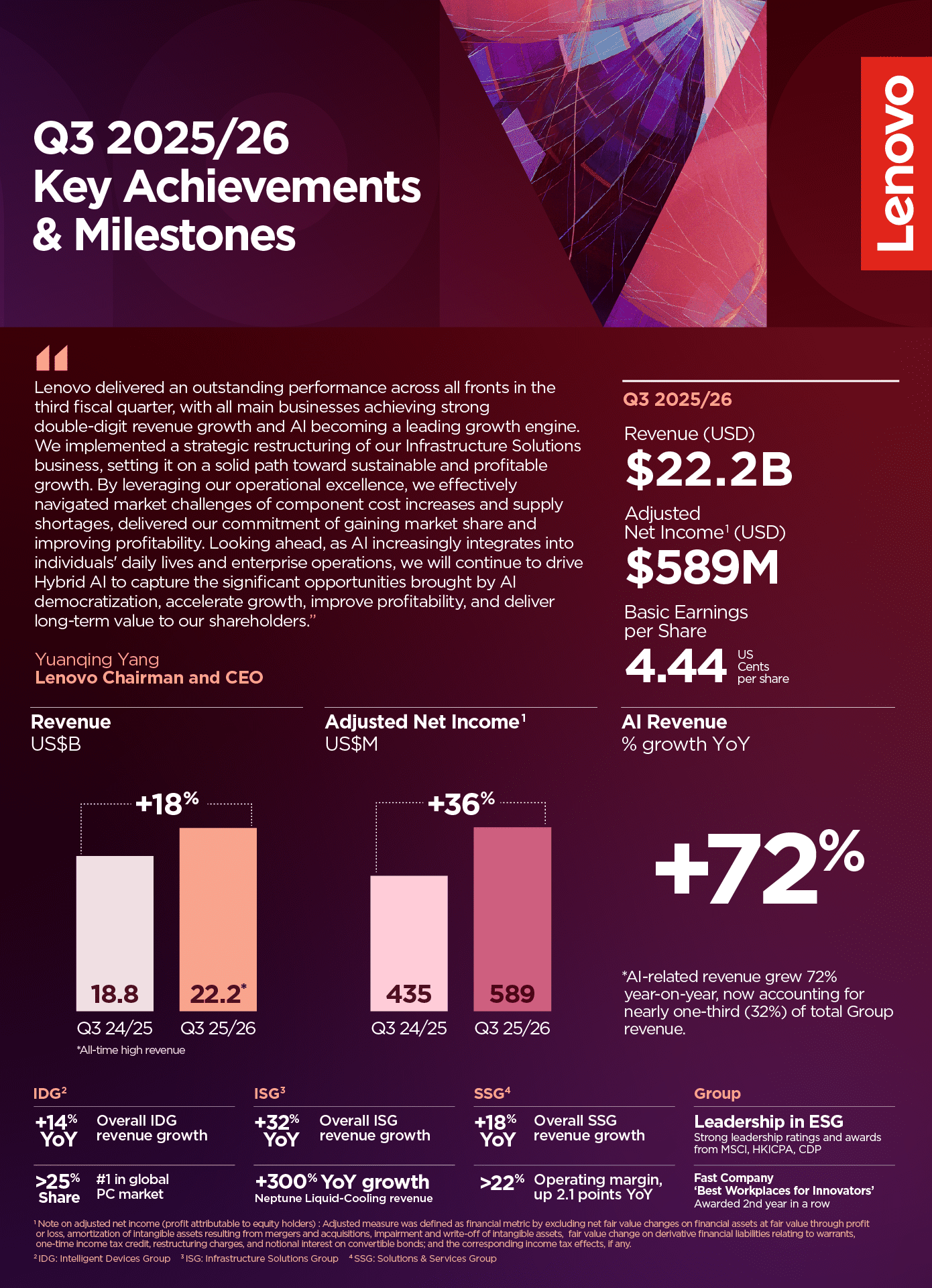

Lenovo today reported results for the third quarter of fiscal year 2025/26, a quarter that delivered record revenues, accelerated profitability, and continued AI revenue expansion. During the quarter, overall group revenue reached an all-time fiscal quarter high of US$22.2 billion, up 18% year-on-year, with revenue from all business groups growing double-digit year-on-year. Excluding non-operating non-cash items and one-time gains and charges in Q3 FY24/25 and Q3 FY25/26, adjusted net income (profit attributable to equity holders – non-HKFRS)[1] increased by 36% year-on-year to US$589 million, with adjusted net income margin[1] expanding to 2.7%.

The results demonstrate the Group’s ability to deliver on its promise of double-digit growth and sustained profitability, while proving its ability to manage through cycles by leveraging innovation to drive growth and operational excellence to navigate volatility. AI has become a leading multi-year growth engine for the Group, with AI-related revenue growing 72 percent year-on-year to represent nearly a third (32%) of overall Group revenue, driven by strong demand across AI devices, infrastructure, services, and solutions. The quarter was marked by strong topline growth, driven by expanding market leadership in PCs and Smart Devices, record volume and activation in smartphones, and all-time-high revenue from both the Infrastructure Solutions Group, and Services and Solutions Group.

To better capture the multi-year AI training demand and long-term AI inferencing growth, the Group undertook a strategic restructuring of its ISG business, resulting in one-time restructuring charges in Q3 FY25/26 of US$285 million. The optimized cost structure, streamlined product portfolio, and strengthened sales organization are expected to deliver annual run-rate savings of over US$200 million over the next three years and accelerate the transformation towards profitable and sustainable growth for ISG.

Read more in the full press release.

[1] Note on adjusted net income: Adjusted measure was defined as financial metric by excluding net fair value changes on financial assets at fair value through profit or loss, amortization of intangible assets resulting from mergers and acquisitions, impairment and write-off of intangible assets, fair value change on derivative financial liabilities relating to warrants, one-time income tax credit, restructuring charges, and notional interest on convertible bonds; and the corresponding income tax effects, if any.