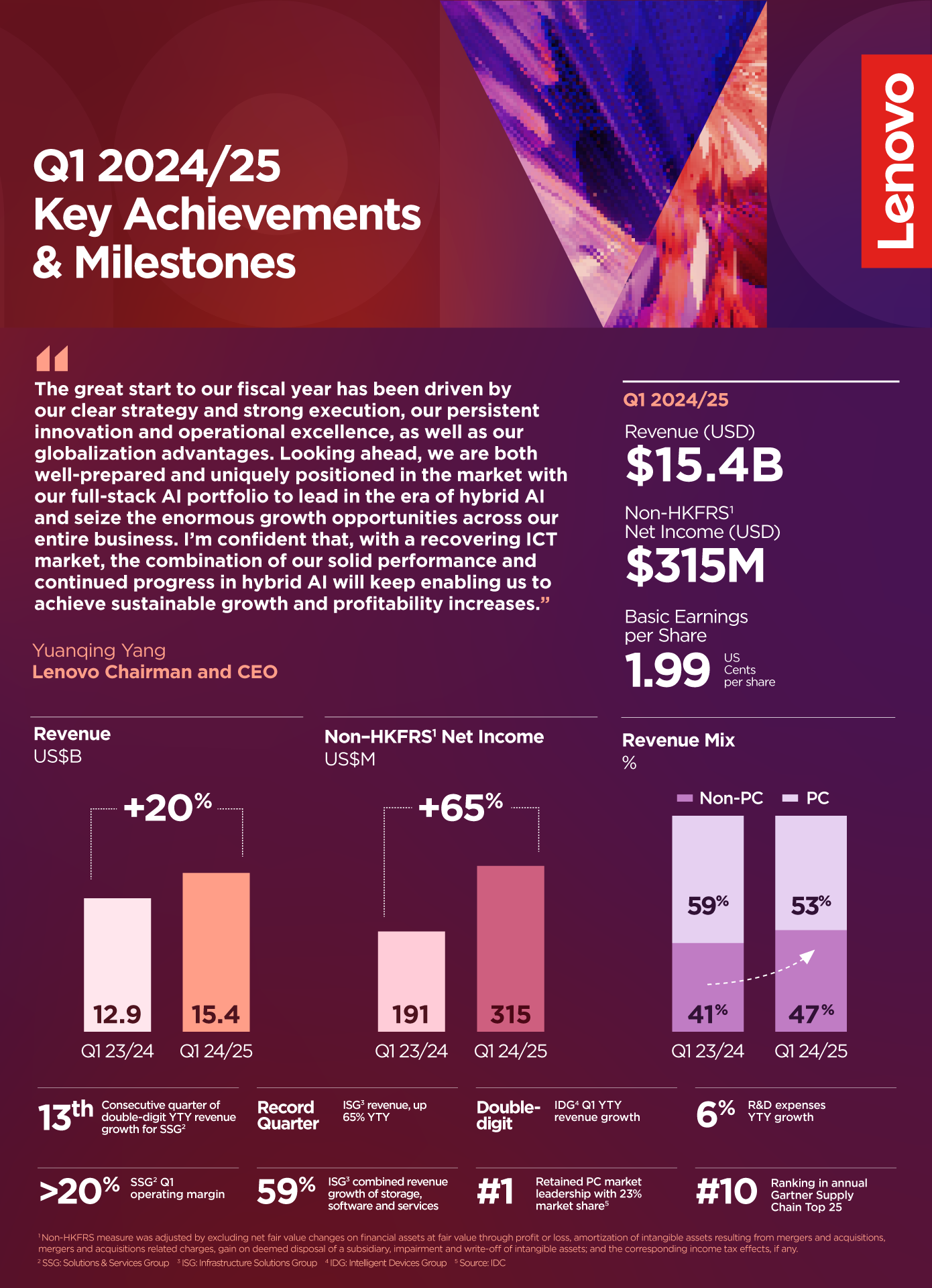

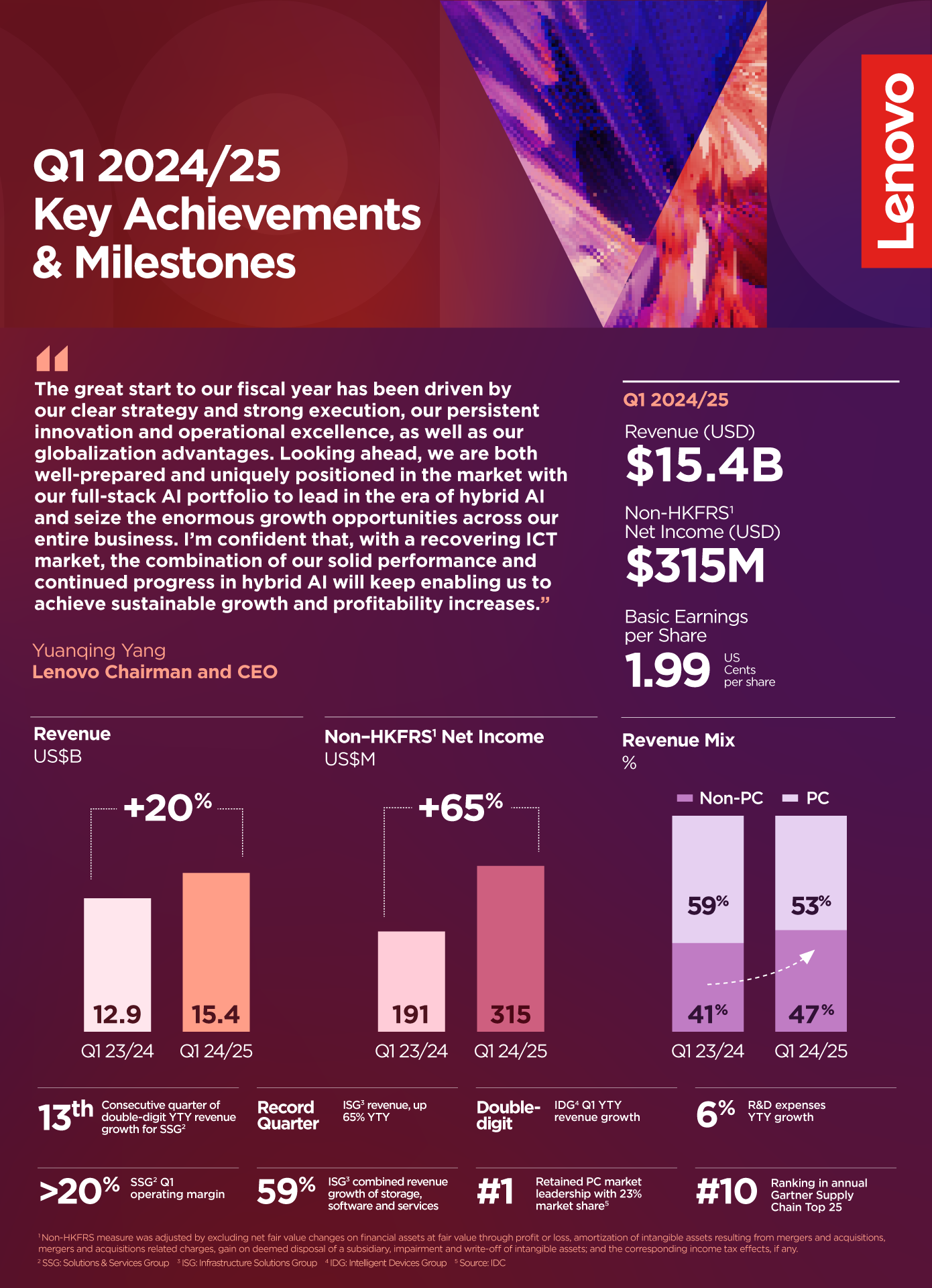

Lenovo today announced Q1 results for fiscal year 2024/25, reporting profitability improvements across all areas of the business and making significant progress in capturing hybrid AI opportunities. Group revenue increased 20% year-on-year to US$15.4 billion, net income was up 65% year-on-year to US$315 million on a non-Hong Kong Financial Reporting Standards (non-HKFRS)[1] basis, and non-PC revenue mix was up five points year-to-year reaching a historic high of 47%. The Group’s results reflect its clear strategy and strong execution, persistent focus on innovation and operational excellence, as well as the advantages it reaps from being a globalized business.

The Group is both uniquely positioned and well-prepared to lead in an era of hybrid AI with its full-stack portfolio featuring AI devices like AI PCs, AI servers that support all major architectures, as well as rich AI native and AI embedded solutions and services. User feedback from Lenovo’s AI PCs, defined by five key characteristics, have been encouraging, with the first AI PCs having launched in May and many more to come during IFA and Tech World later this year. The Group is confident that it will lead the industry in market share for next-generation AI PCs, which overall are expected to be more than 50% of the PC landscape by 2027, as well as lead in seizing the enormous growth opportunities across the IT market. The Group continued its commitment to innovation, with R&D spending up 6% year-to-year to US$476 million.

Looking ahead to growth, in May 2024 Lenovo announced a strategic collaboration with Alat, a subsidiary of PIF, an investment in the form of convertible bonds from Alat, and a warrants issuance. These transactions will greatly benefit the Group’s efforts to accelerate its transformation through greater financial flexibility, seize the enormous business growth momentum in the Middle East, and further diversify and strengthen its supply chain footprint with a new manufacturing hub in the Middle East. The transactions are subject to shareholder and regulatory approvals.

Learn more in the infographic below and check out the full press release.