Highlights:

- The P&C policyholder experience is undergoing a digital transformation

- Evolving technologies serve as the underpinning to improve the digital policyholder experience

- Cloud communications platforms improve the digital experience by enabling engagement, speeding up processes, and providing personalized communications

P&C insurance is experiencing a major shift toward providing an enhanced digital experience for policyholders. The reasons for this change boil down to two essential factors: the increased consumer demand for better digital experiences and the evolution of technologies that make such experiences possible.

This guide explains what a cloud communications solution is and what you should look for when choosing one.

Get guide now

Commenting on the acceleration of digital transformation in the financial services sector, a 2020 Institute of International Finance and Deloitte report observed: “Digital transformation is no longer just a “nice to have.” Neither is it entirely about technology. For financial institutions (FIs), digital transformation is also about improving the customer experience, employee experience, and business economics. In other words, it’s become essential.”

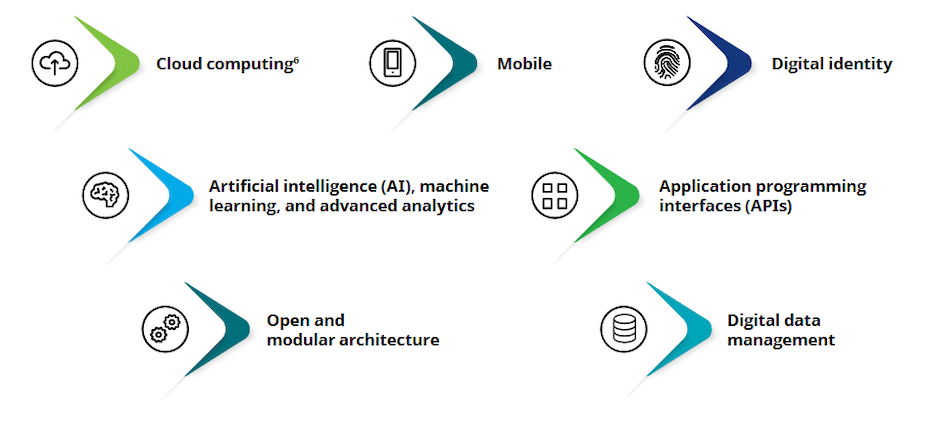

Technologies that support policyholder digital experience

The same report highlighted some of the technological prerequisites for providing an enhanced digital experience, as seen below:

(Source: IIF and Deloitte, “Realizing the Digital Promise: Key Enablers for Digital Transformation in Financial Services”)

In addition to these prerequisites, advances in insurance communications technology also play a vital role in digital experience for policyholders. P&C insurers that have taken a modernized approach to communications enjoy the benefits and efficiencies of technologies such as:

- Multi-contact claim centers

- Digital policy engagement

- Video adjusters

- IVR and self-service options

- Claim routing calls to proper agents

- Policyholder text alerts

- Human-assist claim automation

- Global mobile agent phone services

- Biometrics for authentication

The new P&C insurance policyholder journey

How do these communications technologies impact the policyholder journey? Let’s examine them briefly by means of a typical policyholder’s story.

Sam wants a better rate for his car insurance. He uses his smartphone to compare rates from several insurers. As he narrows down his searches, he wants to talk with a human agent to be sure he understands what he has been reading. With global mobile agent phone services, an agent can answer Sam’s questions from anywhere in the world at any time. This makes Sam happy, as he does not have to wait for an answer to his inquiry.

Sam purchases a policy from the helpful agent, handling the entire process via digital means. He uploads documentation for the insurer and then downloads a digital copy of his new policy, all made possible by digital policy engagement tools. Sam thinks that this insurance policy purchase went more smoothly than any other purchase he has made lately. Once again, he’s happy.

Through the insurer’s secure communications portal, Sam sets up policyholder text alerts to be sure he gets any essential notifications from his insurer. When he has time to read all the fine print in his policy, he has a few questions. He calls the customer contact center and listens to the interactive voice response system (IVR) and chooses a self-service option that answers his question right away. Based on the answer, he decides to increase his coverage a bit, which he is able to do digitally by paying the difference in the premium through a secure payment portal that uses biometric authentication to confirm his identity and keep his data safe.

A few months later, Sam unfortunately has an auto accident and needs to file a claim. Thanks to his insurer’s multi-contact claims center that accurately routes claims calls to the proper agent without delay, Sam is able to get the claims process started quickly and easily with human-assist claims automation. He has a video of the damage to his vehicle, and he quickly uploads it to take advantage of the video adjuster services offered by the insurer. This speeds the claims process, meaning that Sam can get his vehicle repaired more quickly. Sam is a happy policyholder who has taken advantage of new technologies to enjoy a superior digital experience.

Improving the policyholder digital experience with the right cloud communications solution

Choosing the right cloud communications solution enables P&C insurers to provide the type of experiences today’s policyholders want and expect.

Look for a cloud communications solution that includes:

- Telephony

- Chat

- File sharing

- Screen sharing

- Fax

- Advanced call handling

- Contact center capabilities

- Global mobile agent phone services

- SMS or text messaging

- Self-service options

Three ways cloud communications solutions meet the needs of today’s policyholders

Cloud communications solutions facilitate the kind of digital experiences policyholders want by:

- Enabling policyholder engagement through digital channels

- Speeding up client processes

- Personalizing insurance

Enabling customer engagement through digital channels

Financial services communications solutions enable customer engagement through digital channels. Instead of just being able to call their insurers, policyholders can open a live chat or start a video conference. Telephony is still an option for those who want it.

Moreover, digital channels make it easy for policyholders and insurers to share and receive information. For example, during a live chat, a policyholder could upload a photo of the damage a storm did to their house, or the customer service representative could transmit the link to a digital form while discussing the policy over video.

Thirty-four percent of insurance policyholders want to be able to choose the digital channel with which they communicate with insurers, so a financial services communications solution represents an investment toward reaching that goal.

Speeding up client processes

From the client’s perspective, insurance is time-consuming. It can take a while for the policy to go into effect. Then, if you have to file a claim, it could take weeks for the insurance company to even accept the claim (depending on the state a customer lives in, the insurer could have over a month just to decide to reject or accept a claim).

When companies use digital processes to assess and settle claims, the process is 85 percent faster, and there’s a 60 percent reduction in the number of touchpoints used by customers. Moreover, customers report a 15 percent increase in satisfaction.

A financial services communications platform streamlines communications by making it faster and easier for insurance company employees to share information with policyholders and vice versa.

Personalizing insurance

In J.D. Power’s 2021 US Insurance Digital Experience Study, 42 percent of policyholders reported that they chose an insurer based on its ability to provide personalized products and services. A financial services communications solution allows insurers to personalize their services in three ways:

- A dedicated hotline for policyholders

- Customer service representative access to information about the policyholder

- Access to behavioral analytics that reveals important clues about the policyholder

A dedicated hotline for policyholders

A financial services communications solution has contact center functionality. You can leverage this functionality to offer more personalized insurance communications.

Here’s what it would look like in practice. A policyholder calls to file a P&C claim. The call will be routed directly to a customer service representative who’s familiar with the file. That way, the policyholder feels that the insurance company cares about him and his needs.

Customer service representative access to information about the policyholder

When a customer service representative communicates with the policyholder through any channel, the interaction will be much smoother and effective if the representative has information about the customer.

Financial services communications solutions integrate with systems of record such CRMs so the customer service representative understands a policyholder’s situation and is able to solve the problem.

Access to behavioral analytics that reveals important clues about the policyholder

In addition to basic demographic information, insurers now have access to behavioral analytics that allow them a glimpse into the life of their policyholders. Armed with this additional layer of rich data, an insurer can offer product and service recommendations that are highly personalized to the policyholder.

Offer an excellent P&C insurance experience with RingCentral’s cloud communications platform

RingCentral’s cloud communications platform enables policyholder engagement through digital channels, speeds up client processes, and personalizes insurance. To learn more, get a demo.

Originally published Oct 05, 2021, updated Sep 28, 2021